Posted by BW Actual on Jul 25th 2022

BLACKWATER USA | DAILY BRIEF

China

- A Bloomberg article pasted below describes a decline in China's Belt and Road investments in recent years, as well as a shift from infrastructure projects to technology and health initiatives during the pandemic.

- Meanwhile, China released new birth data that showed a slowdown in its population growth rate. Based on that trend, state media estimated China's population will start to shrink by 2025.

- China successfully launched and docked a new module to its space station using a Long March 5B rocket. The 10-story, 23-ton rocket booster that blasted the new module into space is now falling back down to earth - and it's not clear where it will land. Similar reckless Chinese launches in 2020 and 2021 saw boosters fall on a village in Ivory Coast - causing damage but no injuries - and into the Indian Ocean near the Maldives.

- Pres. Zelensky said Ukrainian forces have started a counteroffensive to retake Kherson, beginning with efforts to cut off Russian troops from their supply lines.

- After initially denying responsibility for missile strikes in Odessa, Russia now says it targeted a cache of Western-supplied weapons. The strikes raised concern for a nascent deal to release Ukrainian grain exports for global sale, although it seems Ukraine is still trying to salvage the deal.

Russia

- Russia's Foreign Minister, Sergey Lavrov, is on a charm tour of Congo-Brazzaville, Egypt, Ethiopia, and Uganda. He's meeting African leaders to try to change the narrative and blame the West - not Russia - for blockages in grain exports causing hunger in Africa.

- Some more salacious Western tabloids are airing Ukrainian claims that Pres. Putin may have been replaced by a more energetic body double during his recent trip to Iran. These are the same tabloids still reporting that Putin is gravely ill - a claim the CIA thinks is false.

- Guyana expects to collect $1 billion in oil and gas revenue in 2022, per Rystad Energy Research. Since 2015, more offshore reserves have been discovered in Guyana than in any other country - 11.2 billion barrels of oil equivalent - and Rystad thinks annual oil revenues could reach $7.5 billion by 2030.

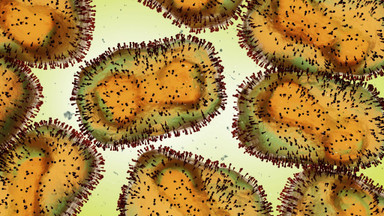

- The World Health Organization declared monkeybox a global health emergency. There have been at least 16,000 diagnosed cases in 75 countries, including many people who don't know where they got sick - a worrying sign that monkeypox is spreading undetected. Experts think hundreds of thousands of people could become infected in the year or more that it may take to control the outbreak.

- Myanmar carried out its first executions in decades, killing four democracy activists who were found guilty of "terror acts" - i.e., helping insurgents fight the junta - in closed-door trials last winter and spring. The executions make it unlikely the junta will find peace with the Arakan Army insurgency any time soon.

China didn’t finance any new projects in Russia, Sri Lanka and Egypt through its Belt and Road Initiative in the first half of this year, with that drop contributing to the continued slowdown in the money being spent on the project.

There was $28.4 billion in financing and investments for BRI projects in the first six months of this year, down from $29.4 billion in the same period a year earlier, according to a study by the Green Finance & Development Center, an affiliate of Fudan University in Shanghai.

The Belt and Road started losing steam in 2017, after China strengthened capital controls to stem a slump in its own currency and an increasing number of overseas projects ran into trouble. The pandemic has exacerbated those issues, with countries in Asia and Africa especially struggling to repay loans or defaulting. That is reflected in the new data, which shows a 40% drop from the first half of 2019.

About $11.8 billion of China’s BRI engagement in the first half of the year went toward investments and $16.5 billion went to construction contracts partly financed by Chinese loans. That took China’s total financial engagement since the initiative’s launch in 2013 to $931 billion, according to the report.

Energy Spending

Energy and transport continued to be the focus of BRI in infrastructure, taking up 73% of overall spending in the first six month of this year, up from 63% a year ago. The largest share of funding went to the Middle East, which received a third of the total.

Saudi Arabia was the single largest recipient of investments, with about $5.5 billion in new funds, while Iraq received around $1.5 billion for construction. The Philippines and Serbia also got substantial new construction projects.

Russia remained the second-most important partner for spending in the energy sector between 2013 and 2022 even though no fresh BRI funds were added there in January-June. It was second behind Pakistan and followed by Iraq and Saudi Arabia.

No coal projects received funds in the first half, according to the study. That continues the trend in 2021, when no BRI money was spent on coal projects in the first half of the year.

President Xi Jinping announced in September last year that China plans to stop building new coal-fired power plants in other nations, a year after he pledged to make China carbon-neutral by 2060. The move could end one of the last sources of international funding for burning the dirtiest fossil fuel, as more than 70% of all coal plants built today rely on Chinese funding.

Spending on technology surged 300% and jumped 209% in the health sector in the first half of 2022, while investments in logistics, consumer products and agriculture fell.

China’s BRI program has been criticized by western nations in recent years, with the US and others accusing it of using “debt diplomacy” to make developing nations more dependent. Beijing has denied those accusations, and the project has led to the development of needed infrastructure projects in some nations.

The US resuscitated an initiative at the Group of Seven summit last month that’s pitched as a direct alternative to the Chinese program. The “Partnership for Global Infrastructure and Investment” aims to fund projects in middle- and low-income countries to the tune of $600 billion over the next five years, mostly through private sector investments with some funding from governments.